In the interconnected global economy, international money transfers are commonplace. Whether it’s for business transactions, personal remittances, or cross-border payments, accuracy and efficiency are crucial. This is where the IBAN (International Bank Account Number) checker plays a pivotal role. In this article, we’ll explore the significance of IBAN checkers in facilitating secure and seamless international financial transactions.

Ensuring Accuracy:

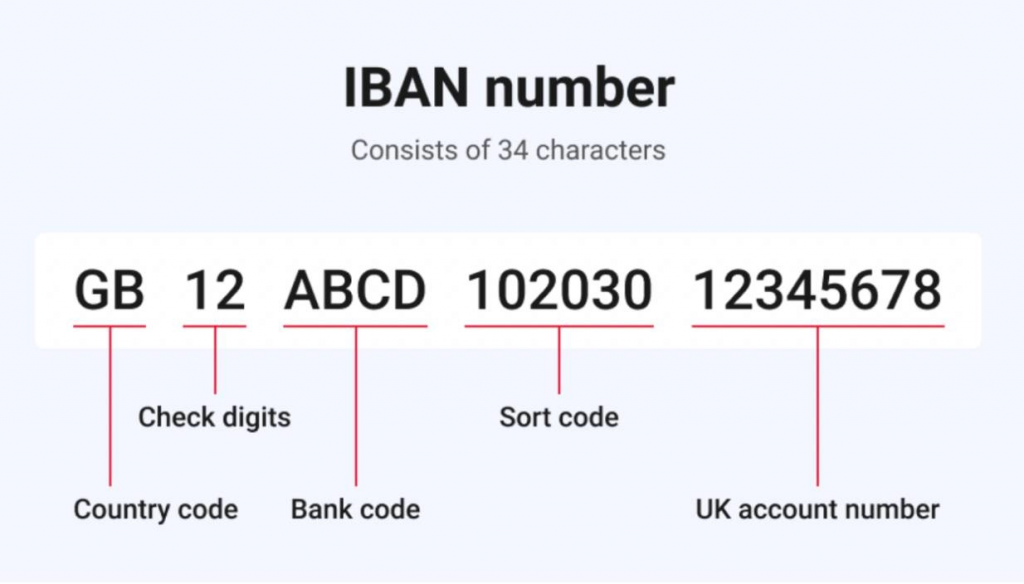

The IBAN is a standardized format for identifying bank accounts across international borders. Each IBAN contains essential information about the recipient’s bank, country, and account details. An IBAN checker validates the correctness of this information, reducing the risk of errors during money transfers. Ensuring that the recipient’s IBAN is accurate is essential to prevent funds from being misrouted or lost in transit.

Minimizing Delays and Fees:

Incorrect or incomplete IBANs can lead to delays in processing transfers, which can be especially frustrating for urgent payments. In some cases, these errors might result in additional fees, such as correction fees or return fees, further increasing the cost of the transaction. An IBAN checker helps prevent these issues, resulting in smoother and more cost-effective international transfers.

Reducing Fraud Risk:

Fraudulent activities are a concern in the financial world. Criminals may attempt to manipulate account information to divert funds or deceive individuals and businesses. An IBAN checker serves as an additional layer of protection, helping to detect discrepancies and potentially flag suspicious account details, thereby reducing the risk of falling victim to fraud.

Compliance with Regulatory Standards:

Many financial institutions and payment processors have stringent compliance requirements. Using an IBAN checker ensures that your transactions adhere to these standards. This is particularly crucial for businesses engaged in cross-border transactions, as non-iban checker can lead to penalties or delays.

Seamless Integration:

IBAN checkers are available in various formats, including standalone software, web-based tools, and APIs. This flexibility allows businesses to seamlessly integrate IBAN validation into their existing systems, making it a valuable asset for automating and streamlining payment processes.

In conclusion, the IBAN checker is an essential tool for anyone involved in international money transfers. Its ability to verify IBANs, minimize errors, reduce fees, and enhance security makes it a vital component of a well-functioning global financial system.