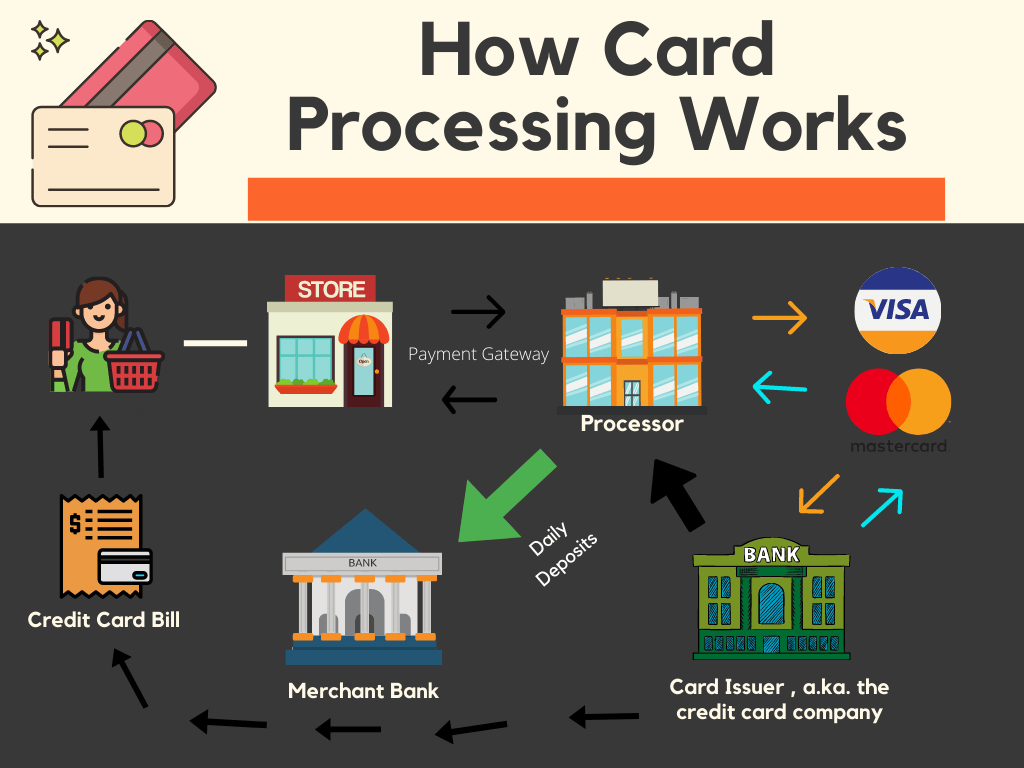

A credit card cost processor represents a critical position in the current financial landscape, helping because the linchpin that facilitates digital transactions between vendors and customers. These processors become intermediaries, connecting corporations with the banking process and permitting the seamless move of funds. The fact of the purpose is based on translating the data from a credit card purchase in to a language understandable by financial institutions, ensuring that payments are approved, processed, and resolved efficiently.

One of the major features of a credit card cost processor is always to improve the performance of transactions. Whenever a customer swipes, inserts, or taps their bank card, the payment processor quickly assesses the purchase facts, communicates with the relevant financial institutions, and validates if the obtain may proceed. This method does occur in a matter of moments, emphasizing the speed and real-time nature of charge card cost processing.

Protection is a paramount concern in the sphere of financial transactions, and bank card cost processors have reached the lead of employing actions to protect sensitive information. Advanced encryption technologies and conformity with industry criteria make certain that client data remains secure throughout the cost process. These safety measures not just safeguard customers but in addition impress rely upon corporations adopting electronic payment methods.

The bank card payment running environment is continually growing, with processors changing to technical advancements and changing customer preferences. Mobile payments, contactless transactions, and the integration of electronic wallets signify the lead of innovation in this domain. Charge card payment processors play an essential role in permitting firms to stay forward of the developments, giving the infrastructure required to support varied cost methods.

Beyond the original brick-and-mortar retail room, credit card payment processors are important in powering the substantial landscape of e-commerce. With the increase of on line shopping, processors aid transactions in a virtual environment, managing the complexities of card-not-present scenarios. The capability to easily understand the difficulties of digital commerce underscores the adaptability and usefulness of bank card cost processors.

World wide commerce relies greatly on charge card payment processors to help transactions across borders. These processors handle currency conversions, handle global conformity requirements, and make sure that businesses can run on an international scale. The interconnectedness of financial systems, reinforced by bank card cost processors, has altered commerce in to a really borderless endeavor.

Charge card payment processors lead considerably to the growth and sustainability of small businesses. By giving digital cost options, these processors enable smaller enterprises to grow their client base and contend on an even enjoying field with larger counterparts. The supply and affordability of bank card payment control companies have become vital enablers for entrepreneurial ventures.

The landscape of bank card payment handling also requires concerns of fraud elimination and regulatory compliance. Cost processors implement powerful methods to discover and prevent fraudulent activities, guarding both firms and consumers. Moreover, staying abreast of ever-evolving regulatory needs ensures that transactions adhere to appropriate criteria, reinforcing the become a credit card processor and integrity of the payment running industry.

In summary, charge card payment processors form the backbone of modern financial transactions, facilitating the smooth movement of resources between organizations and consumers. Their multifaceted position encompasses pace, security, flexibility to scientific shifts, and support for international commerce. As engineering remains to improve and customer preferences evolve, credit card payment processors will remain main to the energetic landscape of digital transactions, surrounding the ongoing future of commerce worldwide.